Welcome to Financielle Money Deals – a monthly guide to the best deals in the UK so you can make the most of your money.

All information correct as at 30 August 2025

In August, the Bank of England base rate was cut to 4.00% The next meeting is set for Thursday 18 September 2025.

This month’s Top 3 Savings Accounts

1. Zopa

Interest Rate 7.10% (for 12 months)

No limit withdrawals

Balance after term £300 pm

Interest Rate 4.36% (ongoing for up to £5,000)

No limit withdrawals

Balance after term 12 months at £5,000

Interest Rate 6.00% (ongoing for up to £5,000)

No limit withdrawals

Balance after term 12 months at £4,000

💳 First Direct – £175 Bonus

- Open a 1st Account & switch with 2 direct debits/standing orders

- Pay in £1,000 (must stay for 24 hours)

- Use the debit card 5 times + log into the app

- Must be new to First Direct & HSBC (since 2018)

- Bonus paid by the 20th of the following month

Click here for more info

💳 TSB – £100 Bonus (plus up to £90 cashback and extras)

- Open a Spend and Save account and complete a full switch

- Log into TSB Mobile Banking App

- Make at least 5 payments using your new debit card

- Do all this by 22 September 2025

- You will then receive £100 between 6th and 12th October

Click here for more info

💳 NatWest – £175 Bonus

- Open an eligible bank account and switch into it within 60 days

- Pay in £1,250 (must stay in the account for 24 hours)

- Log in to the mobile banking app

- You will then receive £125

- Open a Digital Regular Saver within 60 days of completing your switch

- Within 30 days of receiving the £125 you will then receive another £50

- You are not eligible if you have received a switching bonus from NatWest before

Click here for more info

💳 RBS – £125 Bonus

- New customers only

- Pay in £1,250 within 60 days of opening

- Log in to online banking or mobile banking app

- You will receive £125 within 30 days

- Open a digital regular saver (for an additional £50)

- Can’t have received a switching bonus from RBS/NatWest/Ulster bank before

Click here for more info

💰 Barclays Rainy Day Saver – 4.36% interest (up to £5,000) → Requires Barclays Blue Rewards (£5 monthly fee). Click here for more info.

💳 Santander Edge Saver – 6% interest (up to £4,000 for 12 months, you must have a Santander Edge Current Account) + 1% cashback on bills, groceries & travel (£3 monthly fee). Click here for more info.

🛑NB: From 09 September 2025 Santander will be stopping their 1% cashback

💸 Santander Regular Saver – 5% fixed for 12 months. Save up to £200/month, earn £65.01 interest in a year. Click here for more info.

💳 Lloyds

These classic accounts still offer great interest rates:

Club Lloyds Monthly Saver 6.25%

- Save £25 – £400/month

- Withdrawals allowed, £400/month (no withdrawals) gives £150 interest in a year

Monthly Saver 5.25% interest (fixed for 12 months)

- Save £25 – £250/month, £250/month gives £78.75 interest in a year

💡 Fee Alert: Club Lloyds account fee raised from £3 to £5 in June 2025, waived if you deposit £2,000/month

💳 HSBC

- Fixed Rate Cash ISA: 4.00% (up to 13 months, for current account holders)

- Regular Savings Account: 5.00% (1 year, no instant access)

- Fixed Rate Savings: 3.80% (1 year, no instant access)

Online Bonus Saver

- Up to £50,000: 3.75% interest

- Over £50,000: 1.30%

👉 Go to HSBC

💳 Halifax

- Choose between £5 cash/month, a cinema ticket, digital movies or magazines

- Fee: £3/month (waived if you deposit £1,500/month)

🛑NB: From the end of September the monthly reward will no longer be available

Regular Saver 5.50% interest (12 months)

- Save £25 – £250/month, £250/month earns £82.50 interest

💳 Bank of Scotland

- Monthly Saver: 5.50% interest

- 1 Year Fixed Cash ISA: 3.45%

- 2 Year Fixed Cash ISA: 3.35%

- Advantage ISA Saver: 3.00%

💳 Raisin

Not a current account, but offers competitive savings rates:

Fixed Rate Bonds (Deposit: £5,000)

- Shawbrook: 4.33% (1 year)

- Alrayan Bank: 4.32% (1 year)

Easy Access (Deposit: £5,000)

- Shawbrook 4.26% (easy access)

- Vida Savings: 4.25% (easy access)

Scottish Friendly 💰

- Award winning ‘Best Junior ISA provider’

- Invest from £20 a month

- Pay in £50 lump sum

Go to Scottish Friendly Junior ISA

Starling Kite (for 6 to 15 year olds)

- Instant phone notifications when your child spends

- Smart money tools

- Kids version of the App

Go Henry 💰

- Smart features that let kids learn every day

- Gamified money lessons

- Smart parental controls

- Learn to earn (set up tasks app, children can earn extra pocket money)

🛑NB: Get £20 free pocket money by joining before 07 September 2025

Rooster 💰

- Get £5 free with promo code: ROOSTERS

- Flexible parental controls

TSB – Junior ISA

- Earn up to 3.35% tax free

- Open with just £1

- Save up to £9,000 each year

TSB – Young Saver (under 16)

- Earn up to 2.91% AER

- Instant access

- Maintain control of the account until the child turns 16

TSB Bank – Children’s Savings Accounts

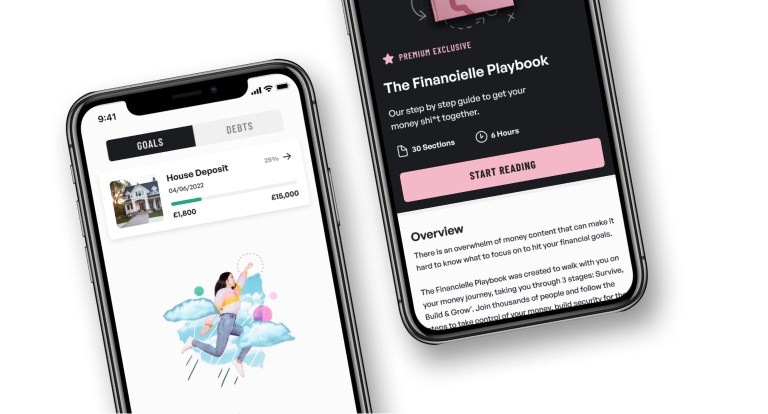

Financielle Money Deals 💸

September 2025 🤑