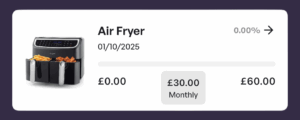

You might have seen it during Love Island – that flashy new ad from Very Pay, singing about “12 months to slay” with air fryers, smartphones and snazzy sofas. It’s catchy. It’s pink. It’s slick. But honestly, it’s also a warning sign.

Image credit: Very / Screenshot for editorial use

Behind the flamingos, duvets and Girls Aloud lyrics is something far less glamorous: Buy Now Pay Later. A form of borrowing that, for many, leads to spending above your means, and before you know it, you’re in a spiral of debt that’s hard to escape.

Here at Financielle, we don’t shy away from calling it what it is: a dangerous tool dressed up as budgeting – and it’s often women being targeted.

Let’s break it down.

The ad is undeniably aimed at women. From the Love Island ad break slot to the hyper-feminine aesthetic, it knows exactly who it’s talking to – and it’s not talking about budgeting. It’s saying: go ahead, buy it now, worry about it later.

And here’s the kicker:

The representative APR is 44.9%.

Let that sink in. If you don’t pay in full during the promotional period? You could be charged almost 50% in interest. That’s not just a fee – that’s a financial hit that could snowball!

Yes, the ad says “pay no interest,” but that comes with fine print:

“Pay in full during the BNPL offer period to avoid backdated interest.”

That means miss one payment, or don’t clear it in time, and suddenly, all that ‘no interest’ turns into a very expensive problem.

BNPL is not a budgeting tool.

It might feel like it’s helping you “spread the cost,” but really, it’s encouraging you to overconsume and delay the consequences. If you really want something – whether it’s a new air fryer or a shiny new phone – the smart, empowered choice is to set up a sinking fund, save for it in advance, and pay in full. No debt, no stress, no nasty surprises.

Change is coming – but it’s not here yet.

New rules are finally on the way. From July 2026, shoppers using BNPL will need to pass stricter affordability checks. It’s a step in the right direction, but until then? Brands are free to glamorise debt with glitter and girlbands.

We’ve had Snoop Dogg and Klarna. Now it’s flamingos and Very Pay. Same message, different glitter.

So next time an ad tells you to “slay now, pay later”?

Take a breath.

Step away from the flamingo. 🦩

And remember – being in control of your money doesn’t come from paying in installments.

It comes from getting your money sh*t together, creating a budget, spending within your means and using sinking funds to save for things you actually want.

If you’re ready to take back control of your money, ditch the debt, and start building a life you can afford – the Financielle App is here to help.