You’ve worked hard to build up some savings – maybe £5,000 – but you’re also carrying £1,000 of debt. The question is: should you dip into your savings to clear that debt?

The short answer: yes, absolutely. At Financielle we’re strong believers that if you have debt, you don’t have savings. Clearing it means no interest draining your money and no stress hanging over you.

Imagine logging into your banking app tomorrow and seeing no debt at all. That light, fresh feeling of freedom is hard to beat.

Why Clearing Debt With Savings Makes Sense

If you’re paying interest on debt while your savings are sitting in a low-interest account, you’re losing money. Debt almost always costs more than you’ll earn on savings. Paying it off is one of the fastest ways to move forward financially.

There’s also the psychological side. Being debt-free reduces stress, boosts confidence, and gives you a clean slate to focus on bigger money goals.

Don’t Skip the Emergency Fund

There’s just one rule: make sure you’ve got a safety net before you clear your debt. That means one month of essential expenses set aside.

Why? Because without it, the next car repair, boiler breakdown, or vet bill could send you right back into borrowing. With an emergency fund in place, you can clear your debt confidently knowing you’ve protected yourself.

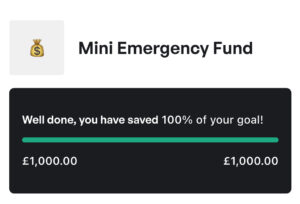

The ‘Survive’ stage of the Financielle method looks like this:

- Know your numbers

- Mini emergency fund

- Ditch debt

Snowball vs Avalanche – What’s Your Style?

Once you’ve got that emergency fund, it’s time to choose your repayment strategy:

- Debt Snowball: Pay off the smallest balance first for quick wins and motivation.

- Debt Avalanche: Pay off the highest-interest debt first to save money long term.

Both work – it’s about finding the method that keeps you moving. (We dive deeper into this in this blog.

Want the Full Financielle Playbook?

If you’re ready to take control of your money, we’ve got you covered:

- Free Playbook: Inside the Financielle app, premium members can find our Playbook on the homepage – a step-by-step guide to getting your money sh*t together.

- Digital Course: For the full roadmap, our Money Playbook course includes 101 lessons, downloadable resources, and quizzes to keep you on track.

P.S. We discussed this topic (and other money dilemmas) on our podcast, The Vault with Financielle. Take a listen here. 🎧