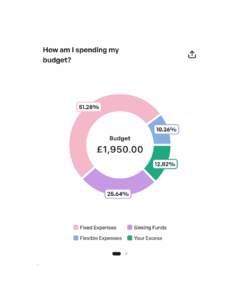

Your excess is what’s left after covering fixed expenses, sinking funds and flexible expenses. It’s the key to paying off debt, building savings and hitting your goals.

But how do you grow your excess without giving up everything you enjoy? Here are a few of our tips to grow your excess ⬇️

1. Trim fixed expenses

🧾 Negotiate bills

Call utility or phone providers and ask for better deals

📺 Cancel unused subscriptions

Do a quick audit of your monthly outgoings and cut anything you don’t use!

🏡 Reduce housing costs

Try negotiating your rent or shop around for cheaper insurance

2. Assess flexible expenses

🌮 Meal plan

Stick to a shopping list to avoid overspending and save time

🛁 Budget friendly fun

Swap nights out for free events or cosy evenings in

💸 Set limits

Use separate accounts and stick to your budgeted spending

3. Audit sinking funds

🍾 Pause non-essentials

Temporarily reduce or stop contributions to funds for non-urgent goals

✈️ Reassess priorities

Focus on sinking funds that align with your current goals

4. Rethink spending habits

⏰ The 48 hour rule

Avoid impulse purchases by giving yourself time to reflect

📲 Track your spending

Track your actuals to identify problem areas

🗓️ Give yourself challenges

Try ‘No Spend’ weeks or reducing takeaways for a month

5. Make simple swaps

🧴 Make brand swaps

Supermarket own brand items are often just as good but cheaper!

🥪 Bring your own

Make coffee at home and pack lunches to reduce convenience spending

🤓 Shop smarter

Use loyalty cards, discounts and cashback apps to save on essentials

Growing your excess helps you pay off debt faster, save more, and invest more. Start with small tweaks and watch your excess grow. We promise, once you turn the focus to growing your excess, you won’t be able to stop 👀