Unless you’re on a social media blackout you’ll know that we’re in the throes of the Amazon Prime event which is a 4 day sale for Amazon Prime members.

Prices slashed across thousands of product lines from Beauty, Home and Clothing the sale is promoted by thousands of influencers online.

It’s tough not to indulge or impulsively spend when the discounts and deals look so good. We’ve even caught ourselves being*potentially* influenced by a few items including;

A case of TRIP drinks (£16)

Oura Ring (£165)

LED Mask (£238)

Spoiler alert. Ahead of the Prime Sale we had no desire to buy any of these items. As Financielle STANs, we use sinking funds to save up for things we’d really like to buy. Sure, we can afford a case of TRIP drinks at £16 but this could be the gateway to impulsive spending.

Check out our top tips to avoid impulsive spending ⬇️

- Budget Budget Budget

Make room in your budget for spending. Setting an appropriate amount that isn’t too small that you’ll never stick to it, but it isn’t too large to get in the way of your financial progress.

This could be a monthly flexible expense or it may be a longer term sinking fund such as clothes, beauty or home.

Learn more about sinking funds here.

- Strategy over willpower

Put in place a strategy to protect yourself from impulsivity. You know how we’re always told not to shop on an empty stomach if we’re trying to eat healthily? It’s because the sugar will call us and the dopamine hit is so tempting it’s hard to rely on willpower.

Strategies you can use include:

- Unfollowing influencers that regularly trigger you to purchase

- Limiting your time on social media

- Unsubscribing from product-based email lists

Whatever it is you need to do to remove the need to spend impulsively, do it.

- Create friction

If your impulse spending comes into play online, it could be time to put some friction in place. If your card details are saved, remove them. Ignore Buy Now Pay Later options at the check out and sit with the products in your basket overnight. If you really want it you can go back for it later.

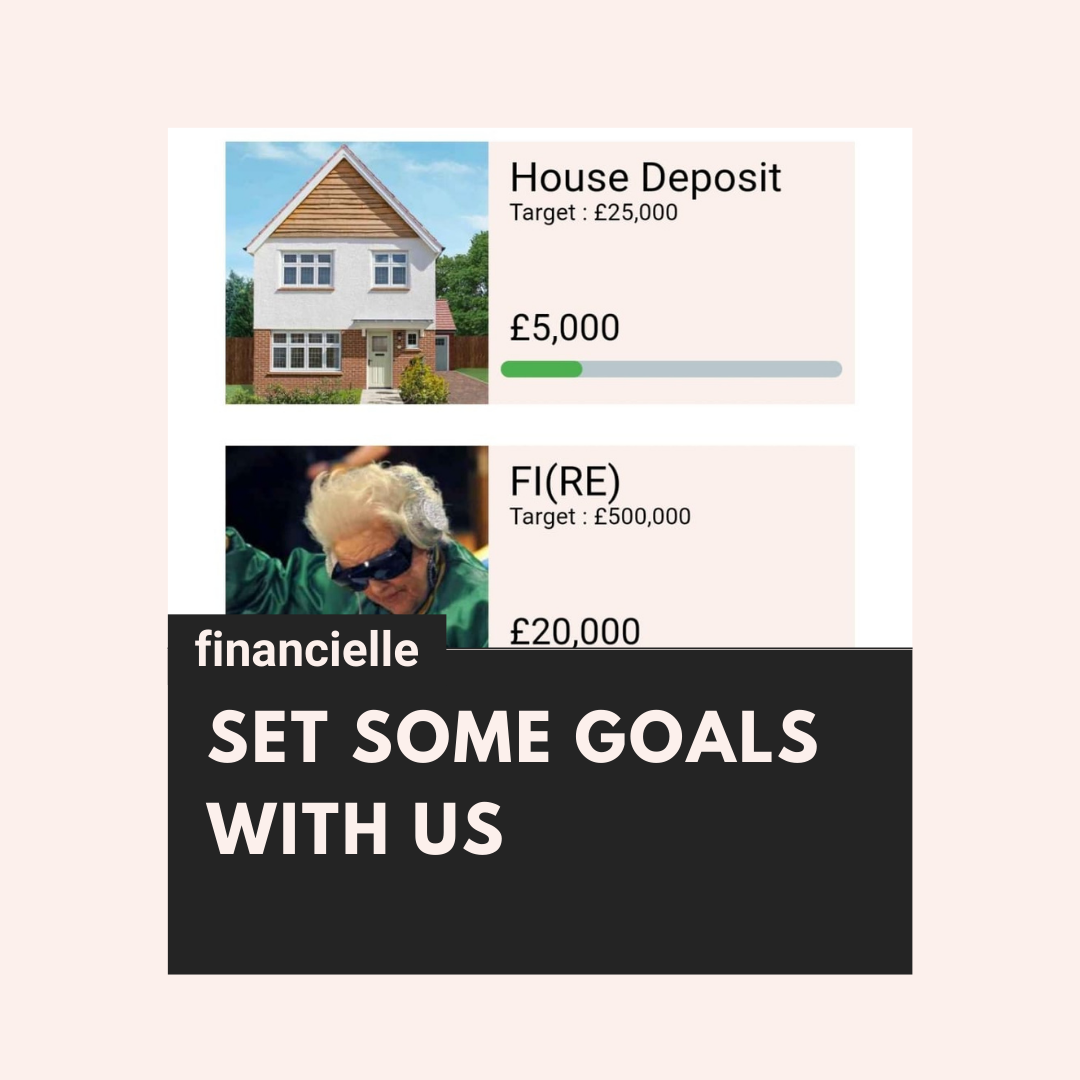

- Focus on your goals

Impulsive spending can get in the way of achieving your big money goals. If you’re looking to buy a house, saving to go travelling or ditching debt, it’s important to make sure they are front and centre of mind. Next time you’re tempted to impulsively spend, consider that you’re potentially pushing your goal further away. One step further? Don’t spend and move that money into your goal fund!

Create your goals for free in the Financielle app here.