Whether you’re a Financielle newbie or a seasoned community member, you’re likely to have heard us banging on about emergency funds. If you don’t have one yet, you’re in the right place!

What is an emergency fund?

An emergency fund is peace of mind. It’s a stash of money you set aside to cover unexpected expenses, helping you avoid relying on debt when life throws surprises your way. Think of it as your safety net. It’s there to keep you covered when things don’t go to plan.

What is an emergency fund for?

Your emergency fund should only be used for genuine emergencies. Things like:

✅ Sudden job loss or reduced income

✅ Unexpected medical expenses

✅ Urgent car repairs

✅ Emergency home repairs

✅ Essential travel (e.g. last minute flights for family emergencies)

What is an emergency fund not for?

🚫 Holidays

🚫 Impulse purchases

🚫 Investing (you need your emergency fund to be easily accessible)

🚫 Treat yourself moments (this is what sinking funds are for)

How to build your emergency fund

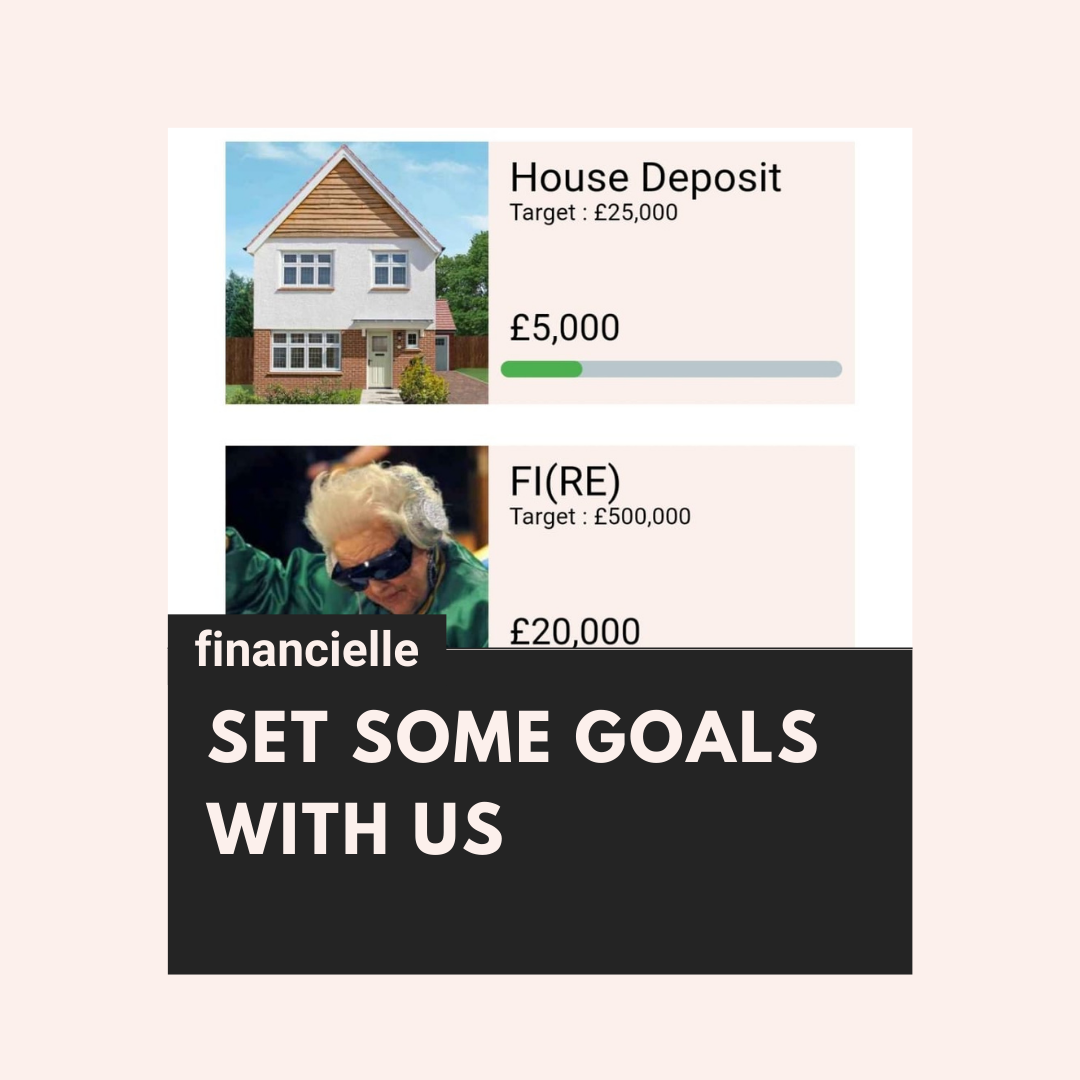

1️⃣ Set your emergency fund goal

We always recommend starting with a mini emergency fund of £1000 or one month’s expenses. Once you have that secured, you will want to start building a bigger emergency fund of 3-6 months’ expenses!

2️⃣ Use your excess from your Financielle budget

The Financielle budgeting method helps you be specific about where you put your money instead of seeing what you have left over at the end of the month. For any money goals, we use our excess – the money left over after we take away our fixed expenses, sinking funds and flexible expenses from our income. Want to create a bigger excess? Here’s how you can do it ⬇️

✨ Reduce non essential expenses

✨ Strip back your sinking funds

✨ Find ways to bring in more income

3️⃣ Keep it separate and accessible

You’ll want to keep your emergency fund in a place that’s easy to access. If you want to find out the best accounts to hold your emergency fund in, check out our latest money deals blog💸

How much should I keep in my emergency fund?

Your emergency fund amount will be completely personal to you. You may be in a stable job where 3-6 months’ expenses stored away is perfect for you. However, you may have a fluctuating income and dependents, in this case, you might want to stretch it to 6-9 months’ expenses.

What if I have debt?

An emergency fund should be everyone’s priority, even if you’re in debt. First prioritise your mini emergency fund, work on clearing your debt then focus on building an even bigger one.

Do I rebuild after using my emergency fund?

Yes! After you use your emergency fund for the first time, you’ll understand how important it is. Go back to your budget and allocate your excess straight back into your emergency fund.