We all love to talk about growing our money, but what about using it to make sure we’re safe?

Like other personal finance products, protection can feel overwhelming, but we’re going to do what we do best and break it down into a simple checklist for you to follow.

What kind of policies are there?

- Term life insurance: Provides coverage for a specified period and pays out if the policyholder passes away during this term

- Decreasing term life insurance: Coverage amount decreases over time, often aligned with a repayment mortgage

How much cover do you need?

- You should aim for coverage that could pay off significant debts e.g. mortgage and provide you with a strong financial cushion

- There are some great calculators online which can help you figure your amount out

How much is it?

- Life insurance is generally more affordable when purchased younger and you are healthier

- The cost is based on age, health and coverage amount2. Critical illness cover

What’s the purpose?

- Provides a lump sum payment upon diagnosis of specified serious illnesses e.g. cancer, heart attack, stroke

- According to cancer research, about 1 in 2 people born in the UK will be diagnosed with cancer at some point in their life

- Critical illness cover offers financial support during treatment and recovery

How much is it?

As an example, our partners Lifesearch quote prices from £5 per month (for example 25 year old, non-smoker- level term critical illness £20,000 over a 25 year term- £5.00 pm)

What’s the purpose?

Replaces a portion of your income if you’re unable to work due to illness or injury

Who should consider it?

It’s a product for almost everyone. ‘Hazardous hobbies’ makes it seem like this is a product for risk takers. In truth, it’s for anyone with an income, which without, they would struggle to fund their financial commitments e.g. Mortgage, Rent , Energy bills or people who don’t have savings to fund their lifestyle including;

- People with dependents

- Self employed & freelancers

- Homeowners & renters

- Anyone without savings

Income Protection Insurance from £6.47 per month ( for example 25 year old, non-smoker, admin assistant, Short Term Income Protection)

- Short term policies – provide benefits for 1-2 years, allowing time to recover or adjust

- Long term policies – offer benefits until retirement age if unable to return to work

Click here to view a Income Protection calculator with our partner Lifesearch.

How much does it cost?

Premiums vary based on occupation, health and coverage amount

The average cost of income protection can be as little as £10, depending on a few factors

If you’d like to talk it through with somebody we’ll try and connect you with a female advisor here.

If you’d prefer to complete an online quote head here.

- Write a will

What’s the purpose?

Your will, or your Last Will & Testament, is a legally binding document that lays out your wishes and how you want your assets to be divided after you’ve died.

Why is it important to have a will?

Writing a will is an important piece of life admin to tick off.

Having a will lets you have a say after you’re gone about the things you really care about: it’s where you decide what happens to your assets, your home, or who looks after your children if you are a parent.

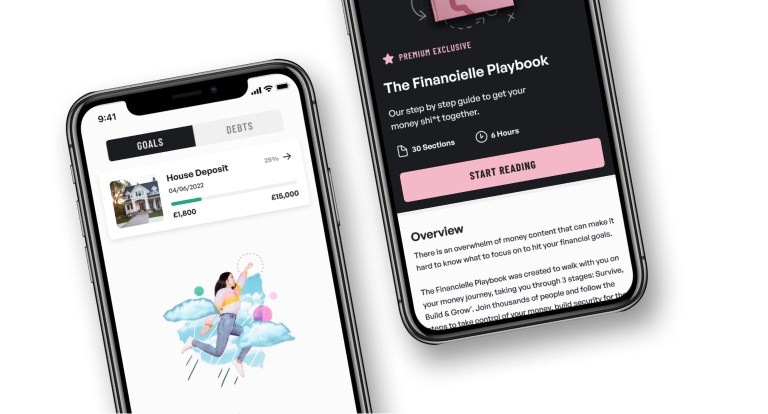

✨Homework

Use this checklist as a self assessment to help you find out if and how much cover you need. We want you to ⬇️

- Evaluate your current financial obligations – debts, monthly expenses, future money goals etc.

- Look at your dependents – who relies on your income?

- Assess current savings – how long and what can your emergency fund cover?

Now you have this information go through and think about each type of cover and figure out what insurance you need.

Head to Financielle to get started.