In a recent TikTok , Made in Chelsea star Louise Thompson shared a candid story about her partner’s financial habits – specifically, his tendency to spend money he doesn’t have. We know this scenario resonates with so many Financielle users.

Money personalities can vary from person to person and knowing your money management habits can help you build strong financial foundations together as a couple.

At Financielle, we understand that money can be a sensitive topic, especially when it intertwines with love. Let’s delve into how to recognise financial red flags and foster healthy money conversations with your partner.

Recognising Financial Red Flags ❤️

- Living beyond means: Consistently spending more than one earns can lead to debt build up and money stress.

- Avoiding money discussions: If your partner is unwilling to discuss finances or becomes defensive, it may indicate deeper issues.

- Secretive spending: Hiding purchases or debts erodes trust and can have long-term implications.

- Lack of money goals: A partner without financial aspirations may hinder joint progress.

Initiating the Money Talk

Open communication is crucial. Here’s how to approach it:

- Choose the right time: Find a calm moment to discuss finances without distractions.

- Be honest and non-dudgmental: Share your concerns without blaming, focusing on mutual goals.

- Set joint goals: Whether it’s saving for a home or planning a holiday, having shared goals can bring you closer together.

- Regular check-ins: Schedule monthly money date nights to keep you accountable.

Tools to Strengthen Your Financial Bond ⚒️

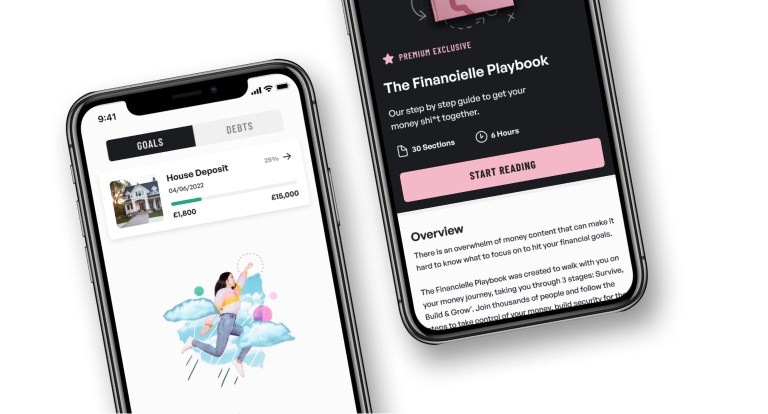

Financielle offers resources to guide couples:

- The Financielle Playbook: A step-by-step guide to taking control of your money together.

- Budget tracker: Monitor spending and savings collaboratively.

- Community support: Connect with others navigating similar money journeys.

Remember, addressing money issues early can prevent future conflicts. It’s not just about money; it’s about building a foundation of trust and shared vision.

It’s time to schedule that money date night and create your Financielle budget together.