I discovered sinking funds a couple of years ago, and since then, I’ve become so invested in them that I think it needs to be studied. In my world, nothing is too big or too small to deserve a sinking fund. They also help me figure out where my spending priorities really are.

In 2022, I came into a bit of unexpected money that, like the proud finance girlie I was (even at 22), I wisely stashed in a savings account. But alas, my good intentions lacked structure or strategy. I used that one account (1.38% AER – collective gasp, 2025-me could never, but I digress) as both my emergency fund and sinking funds. That meant I was financing holidays, topping up my low income, and paying for little treats all from the same pot. Safe to say, it didn’t take long for that account to start wheezing and begging for mercy every time I even glanced its way.

My problem? I kept taking money out of the account, fully intending to replace it with my next paycheck. Did I though? Not a chance. Watching my savings dwindle was freaking me out. My frustration with having no structure or view of what my money’s jobs were was getting stressful. That’s when I realised something had to change.

Around that time, I got very into financial literacy. I started realising I couldn’t wish my goals into existence – I was gonna need a bit of strategy.

How I Use Sinking Funds (and Why They Work)

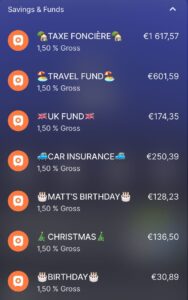

I started playing around with sinking funds over a couple of years and tried a few platforms before landing on Revolut, which has a Pocket feature I’m obsessed with. The real question was: what do I put in them?

I started small with a travel fund and a property tax fund. For me, this was already a massive win. As my confidence grew, so did my clarity around where I wanted my money to grow. Now I have seven sinking funds.

Here’s how I decide how much goes into each fund:

The Financielle Way

I divide the total amount I need (or estimate I’ll need) by the number of months until I’ll need it. I use this for things like travel, Christmas/birthday gifts, car insurance – anything with a deadline.

The “Throw It In and Watch It Grow” Way

I pick a monthly amount that feels doable, and I just keep adding that to the fund until I reach my goal. I use this for longer-term or less time-sensitive things like my home, my UK fund and my animal fund.

The Estimation Way

I use this method for my property tax, since the amount changes every year. I base it on how much I paid last year, divide it by 11, and save that monthly. The rest, if needed, comes from my emergency fund (my endgame is to save more than I need so I never have to dip into my EF).

Using Sinking Funds to Curb Impulse Buys

My sinking funds also double as a way to check if something’s an impulse buy. Whenever I want something over €50, I open a new Pocket and create a sinking fund for that thing. More often than not, I can’t justify using money from my budget to save up for that item, or I just totally forget about it. That shows me I didn’t want it as much as I thought – I close the account, and move on. But if it’s still something I want, it gives me time to save up intentionally. It’s a win-win system.

Peace of Mind > Panic Spending

Sinking funds aren’t just about being able to pay for stuff without using credit. For me, they’re about lowering my cortisol levels every time I think about money. They take away the sense of impending doom whenever I think about paying for anything. And they give me confidence to say “yes” to things without frantically checking my bank account.

They’re how I take care of future me.

I used to have such a strong scarcity mindset, constantly worried I’d go back to living paycheck to paycheck. I’d end up impulse spending what little savings I had because, you know, YOLO (rolls eyes, shakes head). Now, having my babies – aka my sinking funds – gives me the reassurance that the money is there when I need it.

For me, that peace of mind is priceless.

May x