I’m on a mission to get my money sh*t together and whether you like it or not, I’m taking you with me. Instead of overwhelming myself with huge goals and extra pressure, I’m taking a more gentle approach. For the next 7 days, I’m doing one small thing every day that’ll help me feel better about money✨

Here’s my ✨gentle✨7 day reset money challenge.

Day 1: Take a money minute

Today, we’re easing into things with a quick money minute. Take a minute out of your day (I like to do mine as part of my morning routine) to check in on your money situation. Peek at your bank account and get familiar with your numbers if you haven’t already. It might sound simple, but I used to avoid checking my accounts like the plague, so I totally understand if it feels a bit awkward at first.

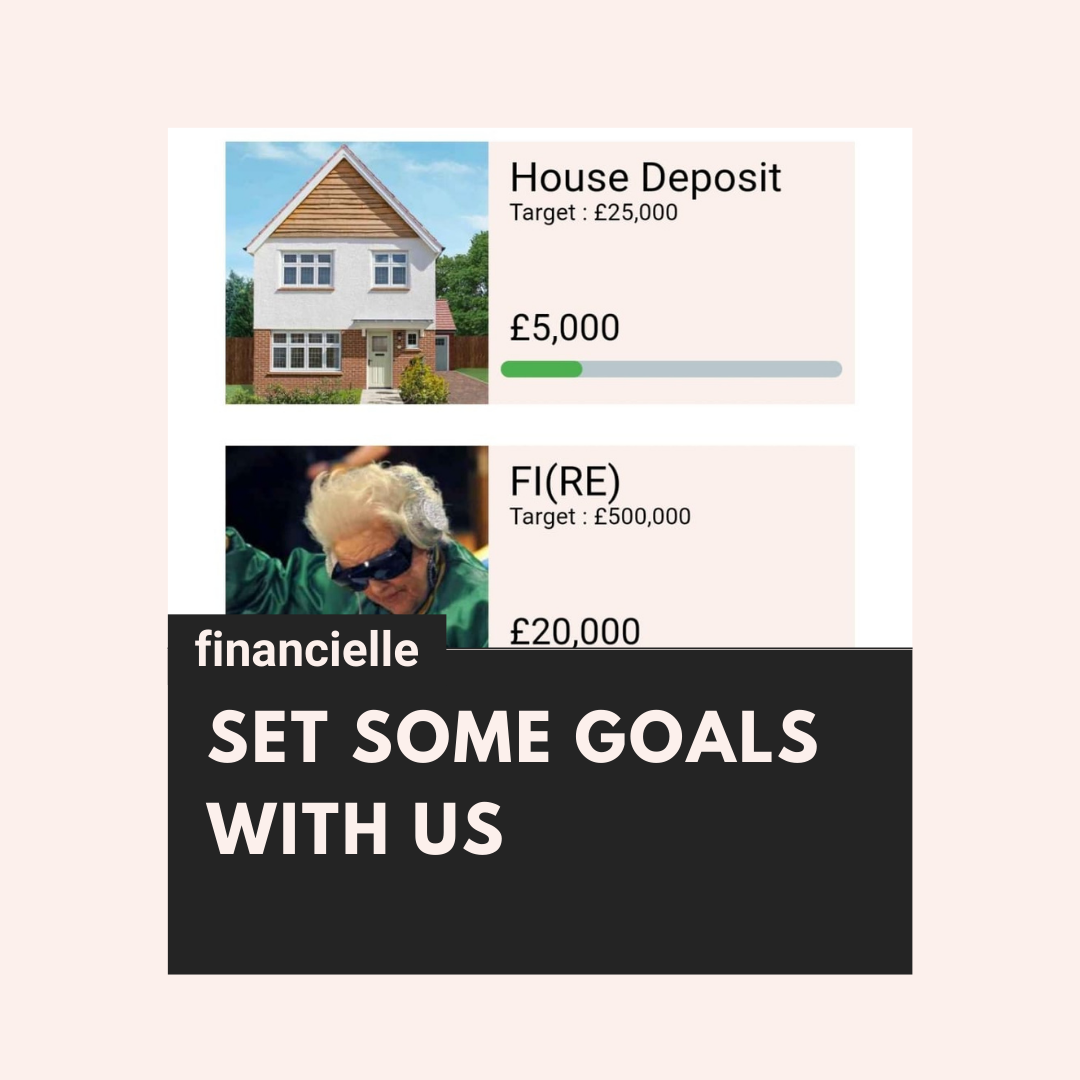

Day 2: Set your money goals

Time to level up a little. That vision board you created? Break it down into specific, trackable goals. I’ve added my aims into my Financielle goal tracker and included some pinterest pics to keep me motivated. Setting clear money goals in the past has really helped me stop dipping into my savings and shaped my budget.

✨Remember: when you have a purpose behind your savings, you’re way less likely to dip into them✨

Day 3: Create your budget

It’s budget day! The foundation of feeling better about money starts with knowing exactly where your money is going. Without a budget, it’s hard to plan for the future.

Grab your budget tracker and create a realistic budget that you can actually stick to.

Day 4: Make sure your money is in the right place

I used to have my emergency fund and savings within one account and it involved so much mental math whenever I’d look at my bank, nevermind the fact I was missing out on interest. This is your sign to do a mini audit and put your savings to work! I keep my emergency fund in a Cash ISA now.

When investing your capital is at risk*

Day 5: Spending review

Let’s reflect on your recent spending. Think about any big purchases you might regret, where you overspent and whether you hit your savings goals.

Taking a step back to review your progress can be the perfect motivation to adjust your strategy and make even better money decisions moving forward.

Day 6: Sinking funds save lives

If you haven’t jumped on the sinking funds train yet, now’s your chance. Sinking funds are pots of money you build up over time for specific, expected expenses. For example, if you’re planning to spend around £1200 during the festive season, open a sinking fund and set aside a bit each month until you hit your target. It’s the best way to save up for what you want without relying on credit. You can track your sinking funds in the Financielle app!

Day 7: No spend day

Today, challenge yourself to a no spend day and give your bank account a break! Whether it’s your first time or you’re a seasoned no spender, try to find joy in simple pleasures: make your own coffee at home, take a long walk or settle in for a chill day on Netflix. Every little bit counts when it comes to reaching your money goals.

*indicates a tracked link, which tells our partner that we sent you and may in the future result in a payment or benefit to our site.