If you’re on the countdown to parental or adoption leave, you’re probably experiencing a whirlwind of emotions: excitement about the new arrival, nervousness about the responsibilities that await – sadness at waving goodbye to colleagues and closing down Teams.

You may even be planning for a future parental leave and wonder what to expect.

Stopping work can also feel like you’re waving goodbye to the security you’re used to. The money side of starting a family can feel like a lot and that’s why the planning starts way before leave starts.

Top tips to taking back control of your parental leave (before it’s even started);

- Know what you’re entitled to

First up company policies: If you’re employed, make sure you know the company’s policies around leave (maternity, paternity, parental and adoption). Some companies offer enhanced leave, some just offer the statutory minimum. Check out what your company offers.

In addition to this, check out what government benefits you may be eligible for. If you’re in the UK, you can search here.

2. Know your numbers

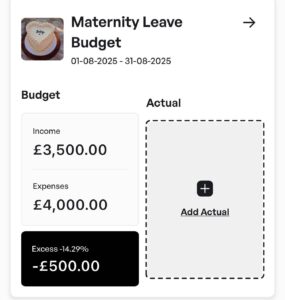

Once you know what any policy says, you can at least work out what these mean for you. It’s helpful to model out a few scenarios: do you want to take off 6 months, 9 months or 12? Are you sharing parental leave with a partner? Will there be a short fall in your budget?

Once you’ve figured out your numbers, if there’s going to be a gap between what you need and what you will have coming in, you can try to start saving towards it now.

In the Financielle app, you can build budgets in advance and try out different leave scenarios until you find one that feels doable.

3. Create sinking funds

When income drops, life’s regular expenses start to feel a lot bigger. Building sinking funds, which are pots of money you set aside for expected costs, can really take off the pressure. Think car insurance, travel, hair appointments. Having these covered means you’re not panicking mid-leave when your car insurance is up for renewal.

Check out this blog on how to create your sinking funds.

4. Mind the gaps

Be aware of the potential other gaps you may experience financially as a result of parental leave.

Financielle Co-Founder Holly learned this the hard way:

“I was so excited about maternity leave, I didn’t check how it would affect my pension. I didn’t realise that my personal contributions had stopped…which then impacted the government top ups. I missed out on all that growth and compound interest. Looking back, I wish I’d asked the right questions earlier.”

5. Don’t bury your head in the sand

We know picking out the nursery furniture, choosing the pram and buying baby grows are the fun parts of planning for your new arrival. Your future self (and your budget) will thank you for taking the time to sort out your money situation earlier.

Parental leave should feel like a pause, not a panic. Putting in the work to plan it now means more space to be present with your new family.

Want to get started? Start modelling your parental leave budget now in the Financielle App.